Examples of Outcome Measurement Indicators for Small Business Assistance Providers

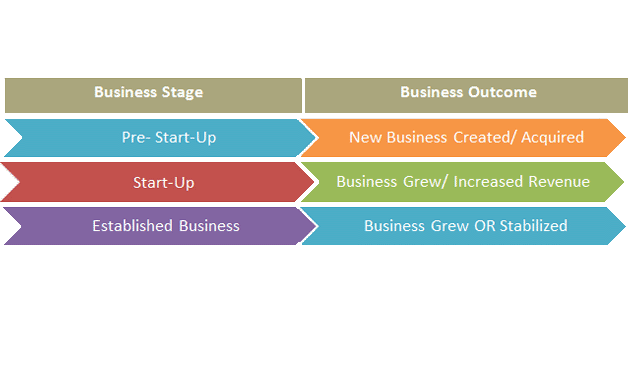

Start New Business: Business opened AND business sales/revenue over a minimum of a continuous three month period:

- Obtained working capital

- Bought an existing business

- Acquired new equipment or products (inventory)

- Obtained a lease

- Created a new legal entity

- Created marketing/advertising materials, designed a website

- Built out commercial space

Maintain/Stabilize Business: Business still in operation at end of reporting period AND one of following indicators:

- Improved cash flow

- Obtained working capital

- Renegotiated better lease terms/moved to better location (w/ better lease terms)

- Refinanced or consolidated existing debt/loan with better terms in order to break even

- Got up to date on rent

- Successful resolution of legal, tax, regulatory, licensing or other problem

- Bought existing business/transfer of ownership

Business Growth:

- Increased gross business revenue

- A net increase of total FTEs from previous year/intake

- Additional business location or increase in square footage

- Purchase of commercial space

- New product line/service/expanded inventory or new (additional, larger, better) equipment

- Rebranding business & marketing materials to increase clients/contracts

Business Capitalization:

- $ value of business loan (direct or indirect) as a result of service intervention

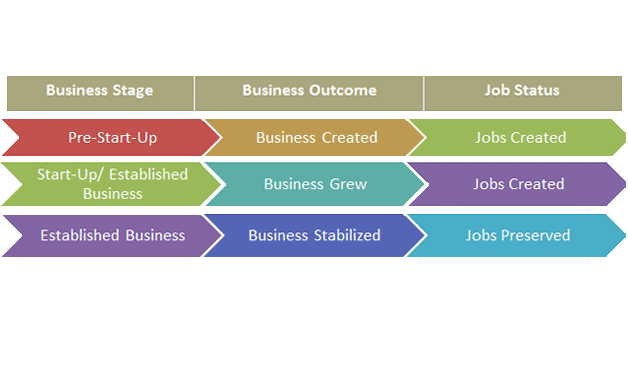

Job Creation and Job Retention

Job Creation: Job Creation is the process of providing new jobs, especially for people who are unemployed (applies to business startups and growth). Based on business owner estimate and verification of jobs.

Indicators:

- Increase in FTEs from prior to TA service to post intervention

- Verified FTEs jobs created for startups and/or growing businesses post TA intervention

- Verified jobs to be created according to business startup and/or growing plan when the business opens or expands by the end of of a given fiscal year or contract period

During a given Fiscal Year grantees must report to MGCC on:

- FTEs jobs created for startups and/or growing businesses post TA intervention

- If a client served by the end of the current Fiscal Year or if the client opens or expand the business by the end of that FY-- report on those jobs created and those jobs to be created according to the business startup and/or growing plan during the coming months.

- Those jobs reported once during the current FY and when the client receives service cannot be reported twice for the next FY to avoid duplication. Grantee will decide when to report the potential jobs to be created during the current FY or when they are effective and verified for the next FY.

- If client creates more jobs than projected and/or reported during a given FY—report on those additional jobs during the next FY.

- If client creates fewer jobs than projected or reported during a given FY—Reduce from your jobs reported or report on those jobs reductions during the next FY.

Job Retention: Jobs maintained at business that would have been lost without service intervention (applies to business stabilization). Based on business owner estimate and verification of jobs.

Indicators:

- Verified FTEs retained for startups and/or growing businesses from prior TA service to post intervention

- Verified jobs to be retained according to business stabilization plan when the business stabilizes by the end of a given fiscal year or contract period

During a given Fiscal Year grantees must report to MGCC on:

- FTEs jobs retained for existing businesses post stabilization TA intervention

- If a client served by the end of the current/or given Fiscal Year or if the client stabilizes the business by the end of that FY-- report on those jobs retained and those jobs to be retained according to the business stabilization plan during the coming months. Grantee must be certain about the # of jobs that will be retained several months after the service was provided.

- Those jobs reported once during the current FY and when the client receives service cannot be reported twice or for the next FY to avoid duplication. Grantee will decide when to report the potential jobs to be retained during the current FY or when they are effective and verified for the next FY.

- If client can retain more jobs than projected and/or reported during a given FY—report on those additional jobs during the next FY.

- If client can only retain fewer jobs than projected or reported during a given FY—Reduce from your jobs reported or report on those jobs reductions during the next FY.